If you wish to become a financial manager, you must be working hard to make a thriving career in the finance field. With suitable education, the right skills and relevant experience, you can increase your chances of employment in this role.

Read much more about what a financial manager does, their responsibilities and how to become one in this post.

What Does a Financial Manager Do?

As the name suggests, a financial manager is a professional who takes care of every crucial finance-related function or process of a company. You can find employment as a financial manager in about every industry. But as a financial manager, you may need to acquire in-demand skills and knowledge to thrive in the field.

Your financial manager job description will include tasks such as supervising the work of accounting teams, making financial reports, analyzing the company performance data and more. A financial manager also offers top management budgeting and investment advice, looking for ways to save expenses and grow profit.

Types of Financial Managers:

- Cash managers: They take care of the cash flow in a business, the money that comes in or goes out.

- Controllers: They overlook the output of financial reports, such as income statements and balance sheets, that reflect and anticipate the organization’s financial reports.

- Risk managers: Their job is to control financial risks to restrict financial losses by implementing functional strategies.

- Credit managers: They decide the company will issue a credit to whom, develop credit rating criteria, and specify and evaluate credit given or received.

- Branch managers: They lead the functioning of a branch office, which includes loan or credit approvals, hiring employees, assisting customers, making relationships with community members and more.

Responsibilities of a Financial Manager:

- Manage company credit and take some dividend pay decisions

- Assess market trends to look for expansion or acquisition opportunities

- Maximize the wealth of shareholders

- Manage financial negotiations with banks or financial institutions

- Find out ways to boost the company’s profitability

- Identify financial risks and make efficient strategies to reduce them

- Interpret financial records

There are many other responsibilities a financial manager role entail. They may vary from one company to another, but more or less, it is everything, almost finance.

How to Become a Financial Manager in India?

Pursue a Bachelor’s Degree

After you have completed your class 12th or any equivalent qualification, you need to enrol for a college degree in business, finance, economics or accounting to make your financial career. The best course you can study to become make a career as a financial manager is a Bachelor of Business Administration (BBA) in Finance.

Opt for an Internship

You can always give an internship a try to explore the field better, know your strengths, work on your weaknesses, build professional connections and learn directly from the industry experts. The experience you get from an internship prepares you for the corporate environment and raises your employability.

Earn a Master’s Degree

You can decide to pursue a master’s degree in one of these areas, which can help you feel more prepared for your preferred career and make you stand out from others. You can demonstrate your additional knowledge and expertise in the industry by acquiring a master’s degree. Students with a degree in MBA in Finance are preferred for financial roles.

Gain Work Experience

Generally, employers seek employees with a minimum of 5 years of industry work experience for a financial manager role. While striving to become a financial manager, you can work as a bank teller, accountant, loan officer and more. Working in a role related to the financial manager, you can get prepared for working in your desired job profile in future.

Skills You Need to Become a Financial Manager:

- Business awareness

- Great communication ability

- Numeral skills

- Analytical thinking

- Detail-oriented

- Proactiveness and problem-solving ability

- Logical thinking

- Time management

- Ability to lead

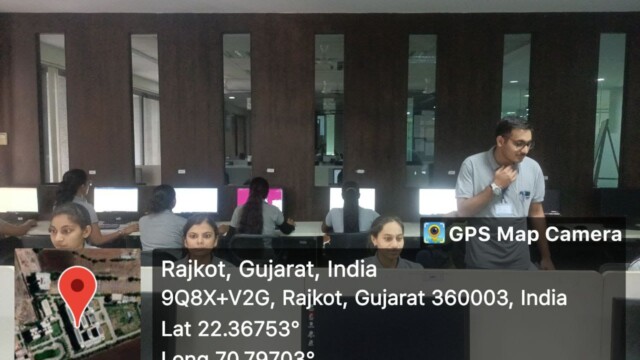

Your education will matter when you strive to achieve a desired and promising role like Financial Manager. The main reason why you should study at a college that provides the most advanced and practical education, like ours – Marwadi University.

At MU, we offer both BBA and MBA in Finance, and whichever you study, we ensure the best education, advanced facilities and excellent placement opportunities.

International Airport

International Airport  Railway Station

Railway Station  GSRTC Bus Port

GSRTC Bus Port