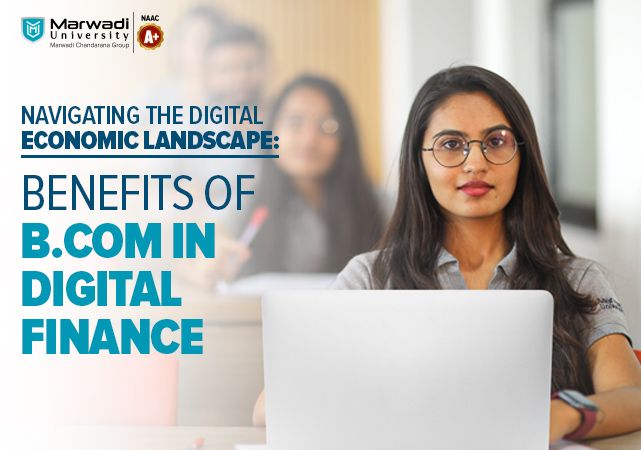

In today’s fast-paced world, where technological advancements and digital convenience are rapidly reshaping every facet of our lives, the realm of finance is no exception. The digital shift in finance management across the globe has revolutionized traditional practices, offering unprecedented opportunities and challenges. Amidst this transformation, pursuing a B.Com in Digital Finance emerges as a strategic move for individuals aiming to thrive in the modern economic landscape.

The Digital Shift in Finance Management Across the Globe

Gone are the days when visiting a physical bank branch was the norm for financial transactions. Ever since technology has entered the financial scape, banks are increasingly prioritizing digital channels, such as net banking and mobile apps, to fulfil customer needs. This shift not only enhances convenience for consumers but also streamlines operations for financial institutions.

The ease in finance management brought about by digitalization cannot be overstated. Tasks that once required significant time and effort, such as fund transfers, bill payments, and account monitoring, can now be accomplished with a few clicks or taps on a screen. Moreover, automation and AI-driven algorithms have significantly reduced the need for human intervention, thereby helping businesses cut down on manpower and operational costs.

What Will You Learn in a Digital Finance Course

A Bachelor’s program in Digital Finance equips students with the knowledge and skills necessary to navigate the complexities of the modern financial landscape. Here’s a glimpse of what you can expect to learn:

Introduction to Fintech: Fintech, short for financial technology, refers to technological innovations that are at the forefront of the digital finance revolution. The course will impart insights into various fintech applications, such as mobile payments, peer-to-peer lending, robo-advisors, crowdfunding platforms, and many more. Understanding fintech trends and innovations is crucial for staying ahead in the dynamic finance industry.

Ways to Mitigate Shortcomings of Current Financial Order with Fintech: Traditional financial systems are not without their limitations, including inefficiencies, lack of transparency, and high transaction costs. Digital finance courses delve into how fintech solutions can address these shortcomings by introducing alternative payment systems, improving accessibility to financial services, and enhancing security measures.

Basic Characteristics of Cryptocurrency and Blockchain Technology: Cryptocurrencies like Bitcoin and Ethereum, powered by blockchain technology, have disrupted traditional notions of currency and led to the emergence of decentralized finance (DeFi). Apart from learning the fundamentals of blockchain technology and cryptographic principles, you will also learn the potential applications of digital currencies in the dynamic financial ecosystem.

Learn How to Efficiently Respond to New Age Financial Challenges: The digital economy presents unique challenges, such as cybersecurity threats, data privacy concerns, and regulatory complexities. A Bachelor’s in Digital Finance equips students with the analytical skills and strategic mindset needed to address these challenges effectively. From risk management to compliance, graduates are well-prepared to navigate the evolving landscape of digital finance.

Career Options with a B.Com in Digital Finance

A Bachelor’s degree in Digital Finance opens up a myriad of career opportunities across various sectors. Graduates may pursue roles such as:

- Financial Analyst: Analyzing market trends, evaluating investment opportunities, and providing strategic financial recommendations.

- Fintech Consultant: Assisting organizations in adopting and implementing fintech solutions to optimize operations and enhance customer experience.

- Blockchain Developer: Designing and developing blockchain-based applications for secure and transparent financial transactions.

- Risk Manager: Identifying and mitigating financial risks, including credit, market, and operational risks, using advanced analytics and risk modeling techniques.

Additionally, graduates may explore opportunities in digital banking, insurance technology (Insurtech), regulatory compliance, and entrepreneurship within the fintech space.

Conclusion

In conclusion, the digitalization of finance has paved the way for a new era of opportunities and challenges. A Bachelor’s degree in Digital Finance imparts the knowledge, skills, and mindset required to thrive in this dynamic landscape. From understanding fintech innovations to leveraging blockchain technology, graduates are poised to make meaningful contributions to the future of finance. Embracing digital finance education is not just a choice but a strategic investment in a career that is at the forefront of innovation and transformation.

And to get a good head start on this journey, you should opt for the digital finance course at Marwadi University, one of the best B.Com colleges in Gujarat. From a dynamic curriculum to top-notch faculties, Marwadi University provides a solid foundation for launching your career in the field of digital finance.

International Airport

International Airport  Railway Station

Railway Station  GSRTC Bus Port

GSRTC Bus Port